Goverment Funding

GOVERMENT FUNDING

Children aged 2 years and over may be entitled to FREE 15 hours of funding if you claim any of the following benefits:

- Income Support.

- Income-based Jobseeker’s Allowance. (JSA)

- Income-related Employment and Support Allowance. (ESA)

- Universal Credit, and your household income is £15,400 a year or less after tax, not including benefit payments.

- the guaranteed element of Pension Credit.

- Child Tax Credit, Working Tax Credit (or both), and your household income is £16,190 a year or less before tax.

- Working Tax Credit 4-week run on (the payment you get when you stop qualifying for Working Tax Credit)

- are looked after by a local authority.

- have an education, health and care (EHC) plan.

- get Disability Living Allowance.

- have left care under an adoption order, special guardianship order or a child arrangements order.

- Meals.

- Nappies.

- Additional hours.

- Additional activities, such as trips.

Currently, all 3 and 4 year olds are entitled to 15 hours a week of free early learning (from the term after their 3rd Birthday).

30 HOUR FUNDING OFFER

For working families.

Are you Eligible?

To qualify, both parents need to be working (or sole parent must be working in a lone parent family) and each parent must earn on average:

A minimum equivalent of 16 hours per week at national minimum wage or national living wage. Each must expect to earn (on average) at least £120 a week.

Less than £100,000 per year

If you, or your partner, are on maternity, paternity or adoption leave, or you're unable to work because you are disabled or have caring responsibilities, you could still be eligible.

What is not covered?

The funded childcare offer does not cover the costs of meals, other consumables such as nappies or additional hours

Providers may charge a fee for these additions.

If you choose to pay for these it is an arrangement between you and the childcare provider.

If you wish to find out more information in relation to 30 hours free childcare and the New Tax Free Childcare scheme please visit:

childcarechoices.gov uk & gov.uk/childcare-calculator

Codes will be issued for you to claim these hours which need to be passed to the nursery to verify.

Please do not hesitate to contact us for more information.

WORKING ENTITLEMENT

Parents who are working and meet the eligibility criteria can apply for up to 15 hours of early education over 38 weeks of the year for 2 year olds up to 30 hours of early education over 38 weeks of the year for 3-4 year olds the entitlement can be used flexibly with one or more childcare providers.

You can get 15 to 30 hours of funded childcare per week for 38 weeks of the year - during school term time. You can split your entitlement over 2 childcare providers, but you cannot have more than your entitlement.

You may be able to buy additional hours from your childcare provider. Speak to your childcare provider to see what they offer.

From September 2024:Up to 15 hours for eligible working families in England with a child between 9 and 23 months old.

From September 2025:Up to 30 hours for eligible working families in England with a child from 9 months old up to school age.

Find out more about government help with childcare costs for parents.

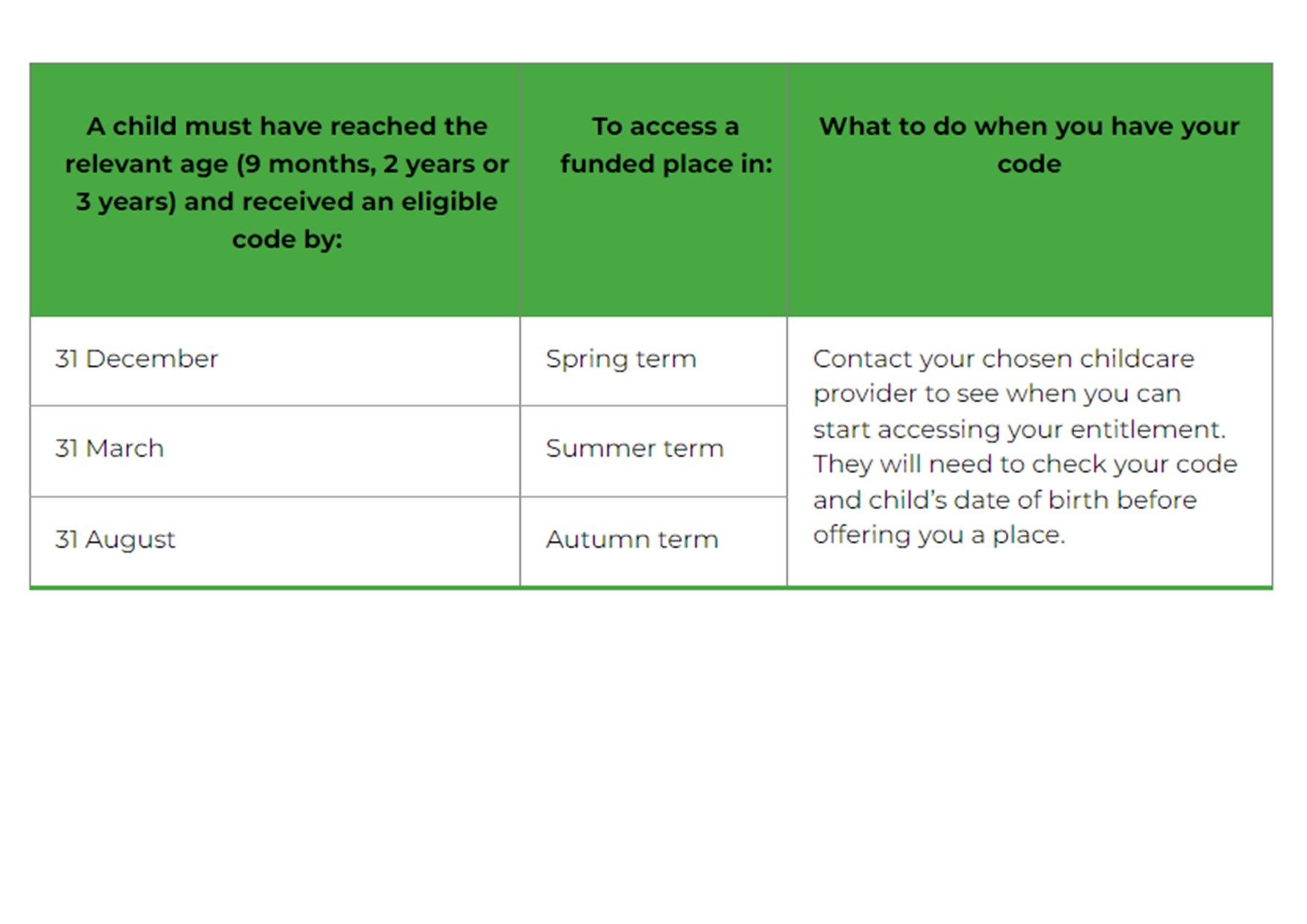

When you apply for working entitlement you will receive a unique 11 digit code.

Your child can access the funded hours the term after your child’s relevant birthday, or the term after they receive their eligibility code – whichever is later.

Apply for working entitlement

You need to apply to HMRC and set up a childcare account.

You will be able to apply for the working entitlement and also Tax-Free childcare at the same time.

Tax Free childcare helps towards your childcare costs where you pay. It usually takes 20 minutes to apply. You may find out if you’re eligible straight away, but it can take longer – make sure you apply in plenty of time to get your code.

You must reconfirm your eligibility every 3 months to remain eligible for 30 hours. If you reconfirm late you may lose 30 hours for the next term. Check your childcare service account for reconfirmation dates.

www.gov.uk/apply-free-childcare-if-youre-working